137: Wealth Formula Banking: The Things We Never Talk About

Podcast: Download

People keep asking me the same question these days—Buck, what are you investing in given the relative instability of asset prices and the economy?

Now I won’t give you financial advice—that is my disclaimer. But I will tell you what I tell everyone else. In times like these, I stick mostly to multifamily real estate and life insurance related products. Why?

Well, in the case of multifamily real estate, people have got to live somewhere. Paying you rent is required so they don’t go homeless. What good is your apple stock if you’ve got no place to live?

What if asset prices go down you ask? Well, as long as you are moderate with leverage and continue to deleverage by creating value, you should be just fine. Again, that’s my opinion and those of you in my investor club know that I am doubling down on this.

What about this whole life insurance product thing? Well, if you don’t know what I’m talking about, take a look at WealthFormulaBanking.com and get a sense for yourself.

You know, it drives me crazy when know-it-all doctors tell me that life insurance is not a good investment. Well, if you look at the way their policies were structured, they are absolutely right. They just aren’t seeing the way the wealthy get these things structured. The wealthiest people in this country, the Romneys, the Rothschilds all use these products to create wealth.

Do you think they might know more than an ER doctor with a blog about this stuff? Well, I’ll leave that up to you.

The good news is that the structure used by the ultra-wealthy for these policies is not just for the rich. It’s about structure. You don’t have to be a millionaire or a billionaire to make these things work for you. And, in unstable financial times like these, dealing with investments that have consistently paid out since before the Civil War might not be a bad idea.

We talk about this stuff a lot and will continue to do so but if you have not checked out WealthFormulaBanking.com do so to get detail. I can honestly say that if you took no other action from Wealth Formula content other than to get familiar with these products, I would feel like I have done a service to you and your financial future.

Today, we are going to talk about the not-so-obvious benefits of these kinds of products that guys like me don’t often think about because all we care about is creating wealth. In fact, there are many strategies that we these policies can be used for other than maximizing leverage and velocity.

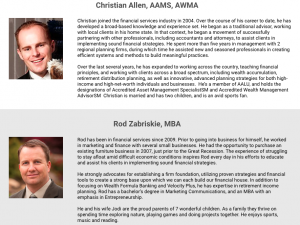

To talk about this, I’ve got the best in the business back on the show this week, Christian Allen and Rod Zabriskie.

Shownotes:

- 30 seconds summary of Wealth Formula Banking

- 30 seconds of Velocity Plus

- Wealth Formula Banking: Don’t I have to pay back interest?

- Long-term insurance market

- Why would life insurance make more sense than term insurance

- Convertible-type policy

- Insurance as part of a comp package

- Getting a policy for your kid

- Common questions and misconceptions

- Not only to protect but to grow your wealth

Send Buck a voice message!

Send Buck a voice message!