336: We’ve Had High Inflation for YEARS and Didn’t Know it

Podcast: Download

I guess by now you’ve heard—we’ve got some inflation problems in the United States and globally and Central Banks are going to continue to ratchet up interest rates in attempts to reverse the tide.

But wait a second. Why inflation now? Didn’t we print billions of dollars over the last 15 years or so? Why didn’t we have inflation then?

Well, we kind of did actually. We’ve had historically low interest rates and quantitative easing since 2008. This kind of “money printing”, however, does not really benefit the common man.

Low interest rates don’t make bananas cost more. But they do make stocks, real estate, and other assets soar in price. Ahh…so that’s where all the money went.

Well, let’s not pretend we as investors did not benefit from this asset class inflation. We did. And of course, banks and institutional money benefitted even more.

But again…the common man did not benefit from the usual money printing methodology. Arguably they weren’t hurt too much either.

But they are getting hurt now because inflation has drifted from the markets to the price of food and energy. Certainly, there are a number of reasons for this.

But, there is one precipitating factor that I believe began the process of shifting inflation to the main street. Before the pandemic, NONE of the efforts by the Fed or fiscal policy put money DIRECTLY into the hands of people who spend it. Of course, that all changed when businesses shut down and the government sent everyone money via parachute.

Now don’t get me wrong. I know we needed to do that. People had to put food on the table. But I do believe that this is where the shift of inflation to the consumer began. Then you layer on screwed up supply chains and high demand for everyday stuff and of course you’re going to have high inflation.

And now the Fed is raising interest rates with a vengeance to try to snuff it out. Will it? A recession and high unemployment probably will. But we have high wages, very low unemployment and continued supply issues. Raising rates doesn’t seem like it would help with those problems.

Anyway, I’m no expert on interest rates and inflation but my guest on Wealth Formula Podcast this week is. He’s written a book on it. Make sure to listen to the show and try to figure out how you might potentially benefit from the economy today.

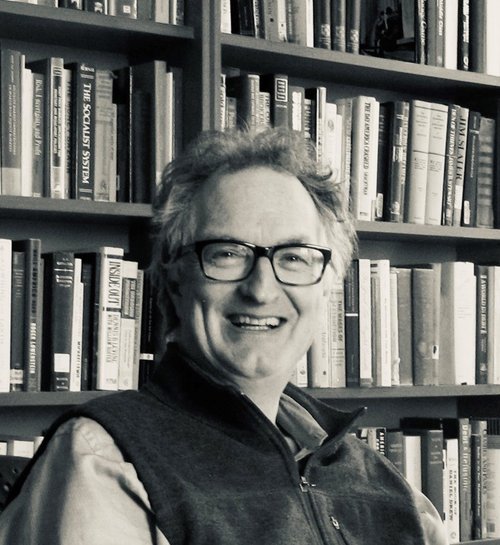

Edward Chancellor is a financial historian, journalist and investment strategist. Edward read history at Trinity College, Cambridge, where he graduated with first-class honours, and later gained an M.Phil. in Enlightenment history from Oxford University. In the early 1990s he worked for the London merchant bank, Lazard Brothers. He was later an editor at the financial commentary site, Breakingviews. From 2008 to 2014, Edward was a senior member of the asset allocation team at GMO, the Boston-based investment firm.

He is currently a columnist for Reuters Breakingviews and an occasional contributor to the Wall Street Journal, MoneyWeek, the New York Review of Books and Financial Times. In 2008, Edward received the George Polk Award for financial reporting for his article “Ponzi Nation” in Institutional Investor magazine.

Edward Chancellor is the author of Devil Take the Hindmost: A History of Financial Speculation (Farrar Straus/Macmillan, 1999), a New York Times Notable Book of the Year. Devil Take the Hindmost has been translated into more than half a dozen languages. In 2005, he published the report, Crunch-Time for Credit? (Harriman House), an analysis of the ongoing credit boom in the US and UK. Edward has also edited two well-received investment books, Capital Account (Thomson Texere, 2004) and Capital Returns (Palgrave Macmillan, 2015).

His latest book, The Price of Time, is published by Allen Lane in the United Kingdom and Atlantic Monthly Press in the United States. The Price of Time has been longlisted for the FT 2022 Business Book of the Year.

Shownotes:

- What was the inflection point that turned an economy that was running on low interest rates and printing a lot of money to a significant inflationary problem?

- The last decade was the greatest period of asset price inflation in history

- Did “Helicopter Money” issued by the government during the pandemic contribute to the high inflation rates we are seeing now?

- The Price of Time: The Real Story of Interest

Send Buck a voice message!

Send Buck a voice message!